28.04.2022 - PDF

Inflation expectations and economic outlook in Austria since the beginning of the pandemic

- The percentage of people expecting stable prices has decreased significantly in the course of the pandemic

- Since April 2020 increasingly more survey respondents had a negative economic outlook

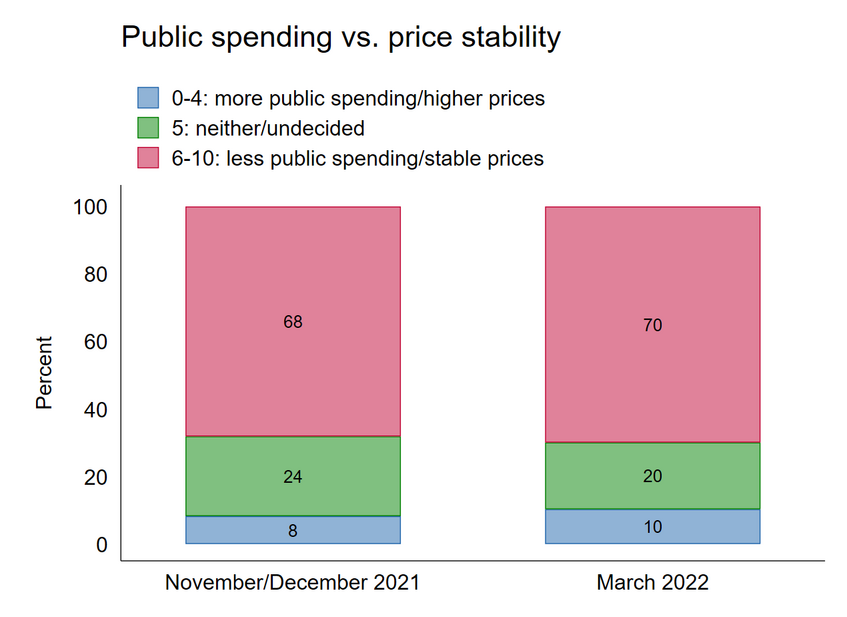

- If high state spending and stable prices were a trade-off, close to 70 percent prefer price stability, while only 10 percent opted for higher state spending

Thomas Resch & Valentina Ausserladscheider

Many European countries, including Austria, experience a rise in inflation rates. The Austrian National Bank calculated an increase of 5,6 percent for the first quarter of 2022 in contrast to recent years, with inflation rates below 2 percent. Among other factors, global supply chain issues due to rapid economic growth after many covid lockdowns have ended as well as the rise in energy prices are responsible for increasing prices. Especially Russia´s invasion in Ukraine and the subsequent sanctions drove prices for oil, gas and electricity in the past weeks.

Studies have shown that aside price changes, also the economic outlook can have a significant effect on people´s inflation expectations. People who hold a more pessimistic perspective towards the prospective development of the economy, tend to expect higher prices. Based on data from the Austrian Corona Panel Project (ACPP), a representative survey, this blog post therefore investigates how Austrian citizens expect prices and the economy to develop in the months to come as well as what counter-measures are preferred in light of rising prices.

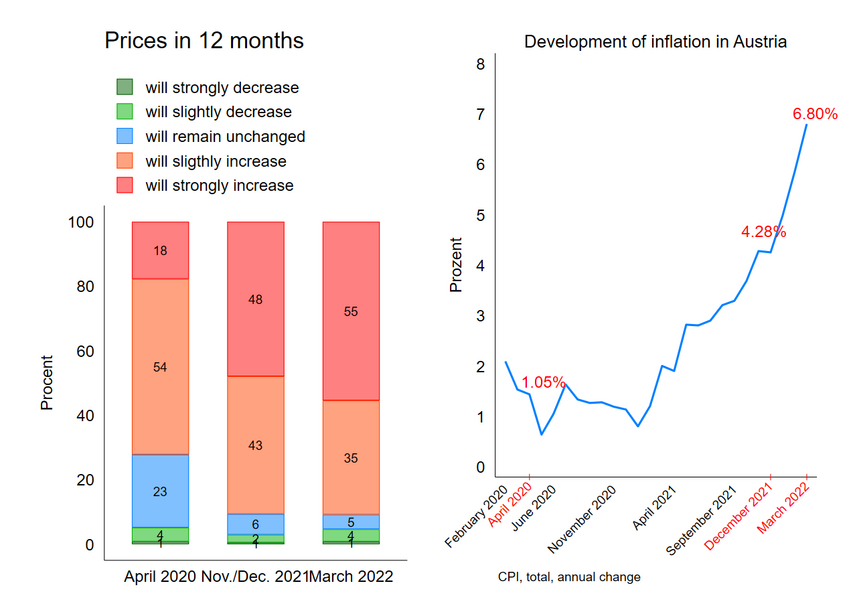

Expected price develompments and the economic outlook

In April 2020, December 2021, and March 2022 respondents have been asked how they expect prices to develop in the next 12 months. Figure 1 shows that a majority already expected higher prices in the beginning of the pandemic. In April 2020, 72 percent believed that prices will increase either “slightly” or “strongly”. By March 2022, this proportion rose to 90 percent, of which 55 percent expected “strong” increases in prices. Reversely, the number of Austrians who believed that prices were going to either remain stable or decrease declined. In April 2020, 23 percent expected “unchanged” prices in contrast to only 6 percent in March 2022. The expectation of rising prices seems to go hand in hand with the actual rise of the Austrian inflation rate, illustrated on the right side of image 1.

Image 1: “Compared to the current situation, how do you think prices and employment rates will develop in the near future? Prices in the next 12 months” Source: ACPP (N=ca. 1400). Inflation rates (CPI, consumer price index) in Austria. Source: data.oecd.org/price/inflation-cpi.htm

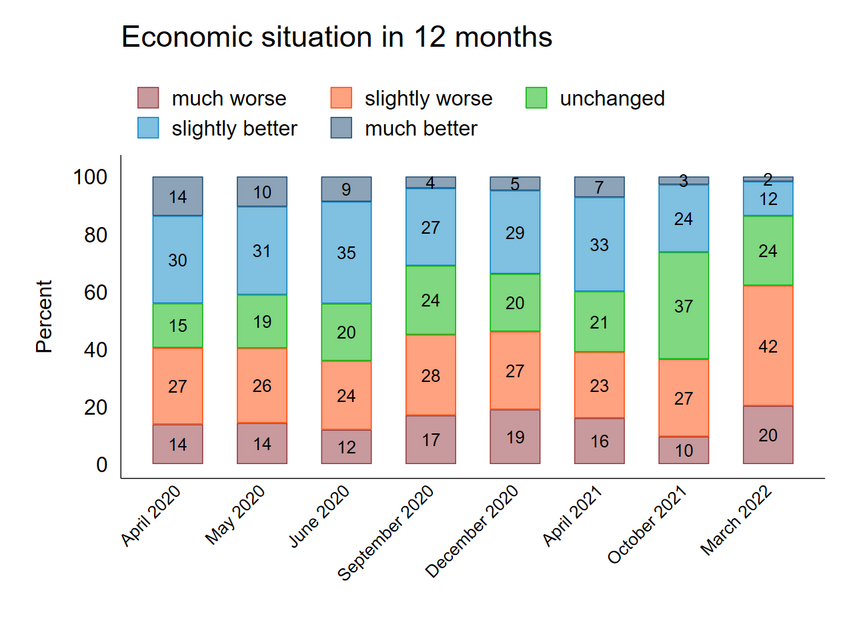

Similarly, there is a clear trend in the development of Austrians´ economic outlook in the course of the pandemic. Since April 2020 respondents have been asked several times “Compared to the current situation, how will the economic situation in Austria develop in the near future?” Image 2 shows that 41 percent of respondents expected that the economic situation in the next 12 months will be either “slightly worse” or “much worse” at the beginning of the pandemic. By March 2022, a majority of respondents with 62 percent held this view. Correspondingly, the proportion of respondents, who expected an improvement of the economic climate decreased. While in April last year 40 percent were still optimistic that the economic situation will be “slightly better” or “much better”, by March 2022 only 14 percent held onto this view.

Image 2: “Compared to the current situation, how do you think the economic situation in Austria will develop in the near future? In the next 12 months.” Source: ACPP (N=1400).

Price stability over higher state spending

In response to rising prices, many demand measures against inflation. While some politicians and other decision makers advocate for the ECB to tighten its monetary policy, the ECB-president Christine Lagarde suggests that EU member states should lower their taxes and provide subsidies to cushion the impact of rising prices and the uncertain economic outlook on citizens´ economic life. Linked to this, there is also a lack of consensus among economists concerning the mechanisms that drive inflation. Some accounts argue that there is a trade-off between high governmental spending and stable prices, which is much debated. While this suggests that prices rise with an extensive increase in spending, others argue that prices stabilise or decrease when states spend more. In order to understand how citizens perceive such an - albeit controversial - trade-off, respondents have been asked to position themselves between “more public spending and higher prices” and “less public spending and stable prices” in December 2021 and March 2022. Even though prices continued to rise in the meantime, the positions remained largely the same. At both points in time close to 70 percent of respondents preferred stable prices over higher public spending. In contrast to this, only 10 percent preferred higher public spending despite high prices.

Image 3: “Some want more public spending and increasing prices, while others want stable prices and less public spending. How would you position yourself on a scale from 0 to 10, where 0 means that you prefer more public spending and increasing prices and 10 means that you prefer less public spending and stable prices?” Source: ACPP (N= ca. 1400)

Conclusion

Since the beginning of the pandemic, the proportion of Austrians, who expected stable prices has declined significantly. Similarly, a majority expected a worsening of the economic climate. Especially in the last months, these trends have intensified. Politicians and other policy makers are also concerned with rising inflation and the negative economic outlook. Even though the relationship between state spending and price stability is controversial, a majority of Austrians prefer measures enhancing price stability over state spending. In sum, the presented data seems to confirm studies that describe the relationship between high inflation expectation and a negative economic outlook.

Thomas Resch is aPhD candidate at the Department of Economic Sociology, University of Vienna. His research focuses on justice, distribution preferences, attitudes towards welfare states, comparative analysis of welfare states and health policies.

Valentina Ausserladscheider is a post-doctoral researcher at the Department of Economic Sociology, University of Vienna and a research affiliate at the Department of Sociology, University of Cambridge. her research is at the intersection between international political economy and economic sociology and focuses on institutional change, political discourse and cultural norms and values in economic theories.

Verwandte Beiträge

- Blog 13 - STAAT – ABER FÜR WEN? Wie Österreich über die Verteilung staatlicher Beihilfen in der Corona-Krise denkt

- Blog 28 - Neue Steuern zur Finanzierung der Kosten der Krise? Steuerpräferenzen in Zeiten von Corona

- Blog 80 - Veränderungen der Haushaltseinkommen in der Corona-Krise: Wer ist betroffen?

- Blog 83 - Die Pandemie könnte den privaten Konsum langfristig reduzieren

- Blog 110 - Entschädigungen für Unternehmen in der Pandemie: Eine Frage der Gerechtigkeit?

- Blog 116 - „Ost-Lockdown“ drückte Konsumstimmung - nicht nur im Osten